Navigating COVID-19:

A Guide for Small and Medium-Sized Business Owners

The spread of COVID-19 and subsequent public policy decisions have created economic uncertainty and instability. These stresses – even if short-term – can nonetheless have a long-lasting negative effect on small businesses and even cause many small businesses to fail. To manage this volatility, small business owners need to implement proper strategic planning.

How Your Business Might Be Affected

Small businesses will be affected by COVID-19 in the following ways:

- Disruption to your operations due to illness of staff or other parties

- Disruption in your supply chain or the supply chain of your vendors resulting in an inability to procure inventory, parts, or supplies

- Reduced revenues and operating losses as a result of reduced demand

- Disruptions in collecting accounts receivable due to economic impact on your customers

- Longer term negative business impact as a result of an economic downturn

While each business is unique, the following sections provide assessments all businesses should consider and guidance on implementing appropriate mitigation steps.

Initial Requirements and Steps

Imagine that you are going to drive to an important meeting. You would begin by setting the intended route and assessing the drive time so you can leave with enough time to make the meeting. Now, let’s say that there is a sudden accident that creates traffic delays.

If you left to the meeting without allowing for additional time this change to your plan may cause you to miss the meeting. Conversely, if you had never considered the drive time, then how would you know when to leave?

You cannot effectively manage the current situation or strategically run any business without a road map and timely and accurate data.

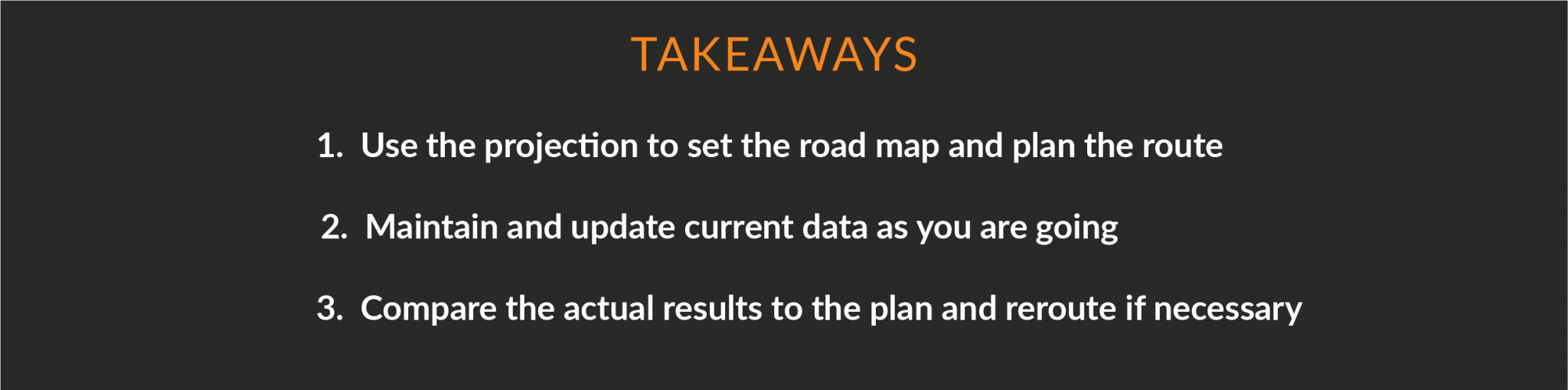

In times of uncertainty, this analysis will focus on cash flow and liquidity, which requires three things:

- A projection so you can plan for what you think is coming

- Updated actual results on a weekly basis

- A comparison of your actual results to your projection and a corresponding strategic decision

For purposes of this exercise, historical financials are not very important because we are focusing on forward-looking liquidity and cash flow. Regardless of the state of your bookkeeping, it is imperative to get reliable numbers on the few initial data points required , setup the projection model provided, and then, critically, allocate the time required to enter the relevant actual performance data on a daily or weekly basis.

Take a Snapshot: Liquidity

The single most important data point in a company’s ability to effectively navigate volatility is its cash position relative to the cash required to fund operations under negative pressure over a period of time.

Liquidity is one measure of whether you will have the cash on hand to fund operations in the coming months. Liquidity is a snapshot of a company’s ability to pay its short-term obligations based on current assets and current liabilities, and is often measured with the quick ratio:

The problem with the quick ratio is that it assumes all your accounts receivable (AR) and inventory can be liquidated at the value booked on the balance sheet. But if sales have decreased you may find yourself sitting on inventory unable to sell it, or only able to sell it for a loss. Or if your customers are having difficulties of their own, you may not collect your outstanding AR on time, or even not at all in some cases. Finally, the quick ratio does not consider the timing of cash flows, nor does it account for negative cash needs resulting from operating losses.

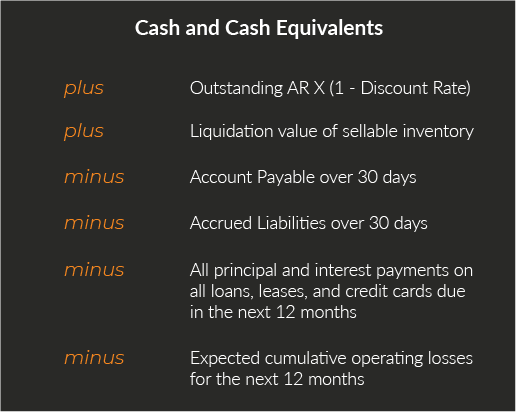

A better way to think about your actual liquidity is as follows:

Operating losses are not typically included in this analysis and from an accounting perspective; but this is about planning for cash flow, not accounting. If you are going to lose $20k per month for six months, then this essentially acts as an offset to your current cash on hand. Do not add projected operating profits in the way operating losses are taken out because such profits assume a level of sales that may be inaccurate, and one does not want to base plans on positive facing assumptions. If planned conservatively, businesses are more prepared to deal with future uncertainty and will not have risked anything if their performance comes in better than projected.

Cash is King

While liquidity is a good directional metric, sound planning requires cash flow analysis as it relates to time. If a business runs out of cash and fails this week, it doesn’t matter that they will get $200k in two weeks. All businesses have a cash conversion cycle (CCC). The CCC is the number of days from the time businesses make various payments to the time they receive payment. The longer that time period, and the higher upfront costs, the more working capital is needed.

Let’s look at a quick example:

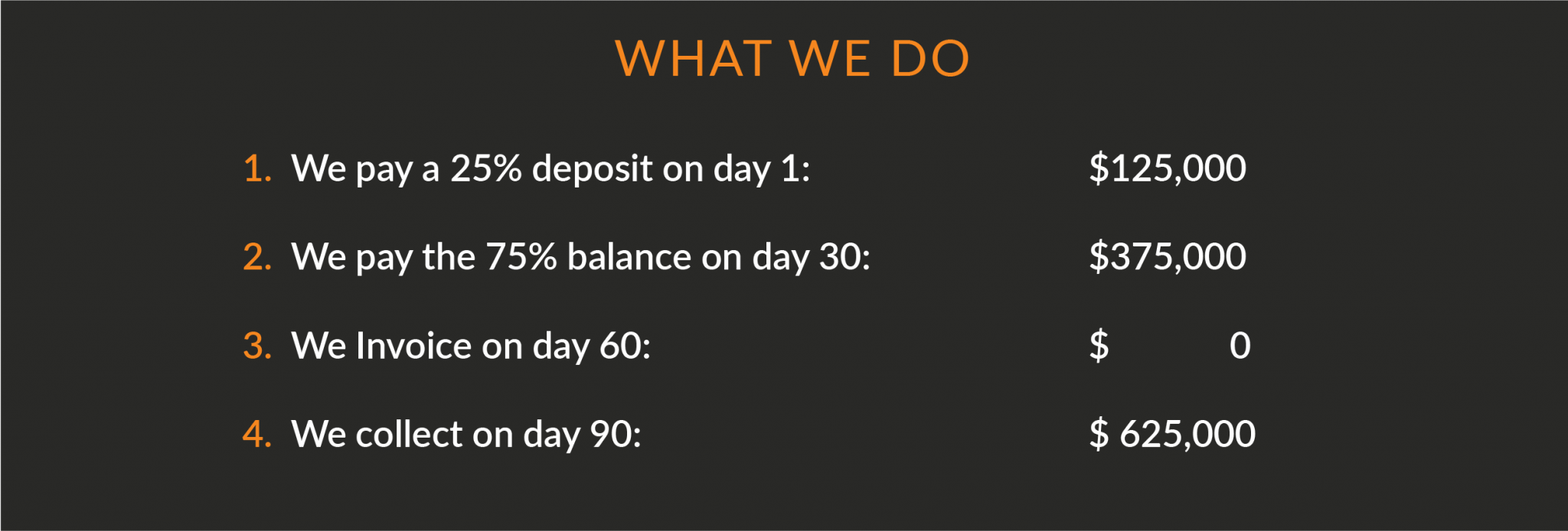

- ABC Manufacturing orders parts from China.

- They pay a deposit of 25% and the balance when the parts arrive in the U.S. 30 days later.

- ABC takes another three weeks to assemble the parts, and one more week to ship their finished product to customers and send invoices.

- Invoices are due 30 days from the date of product delivery.

- Let’s say that the parts ordered are $500k and the gross profit on that order is 25%.

Seeing that our CCC is 90 days. Now let’s also say that there is $40k per month in payroll and cash operating expenses. Over 90 days, that would be an additional $120k of outflows before payment is collected on invoices. That means the business would need $620k ($500k + $120k) in cash to pay for costs if they are to eventually collect the $625k invoice. What if the customers become late paying by 30 or 60 days? This would increase the amount of cash needed during the CCC. Conversely, if they are to get better terms from vendors, this would reduce the cash needed.

Let’s look at the example of a restaurant that gets 30-day terms from its vendors. Since the restaurant gets paid right away and doesn’t have to pay its vendors for another 30 days, it generates cash in its cash conversion cycle; but this doesn’t account for operating cash required. Many restaurants are closed or only partially open as a result of the COVID-19 situation. As a result, the cash flows are not coming in and the restaurant has to figure out if it has enough cash to cover its minimum cash requirements for necessary expenses (e.g. rent, utilities) if the shutdown lasts for 2 weeks, 1 month, 2 months, and so on.

For purposes of planning and strategy, understanding the dynamics of when cash flows in and flows out and the variables that can affect inflow and outflow timing or amounts is paramount, as is being able to analyze different scenarios ahead of time and put contingency plans in place.

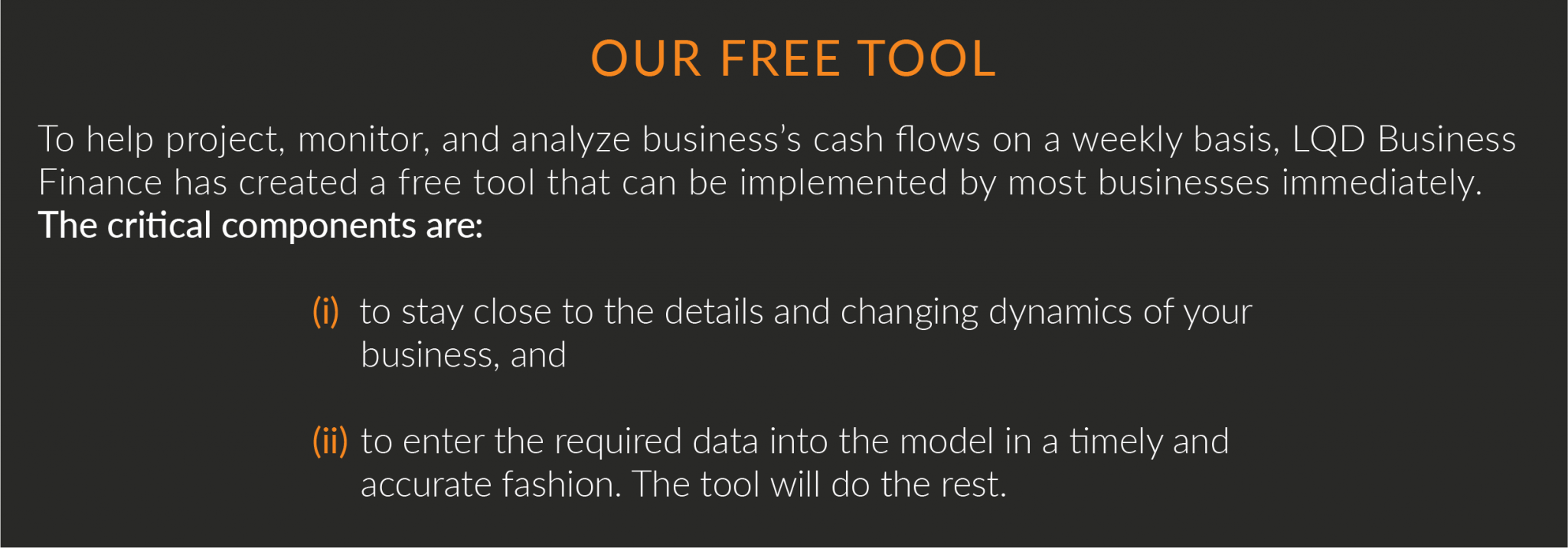

About LQD Business Finance

LQD Business Finance is a Chicago-based tech enabled business lender. LQD was founded in 2014 to serve the small and medium sized business loan market Using a hybrid model that involves human analysts supported by data infrastructure and automation, LQD is able to more efficiently and accurately originate, underwrite, service, and monitor small business loans and loan portfolios

- Small Business Relief

- White Papers