As the owner or executive of a growing business, you will be challenged to navigate a competitive environment. Here, we describe three major challenges you will face as you lead your company to grow.

Market Competition

Your growing business will face immense competition as it grows. If your business has successfully defined its unique competitive advantage, it will quickly scale by securing new customers and maintaining existing customers. More often, this type of success is limited to companies that are first to market or companies that provide a distinctly superior product. If your company sees the market share decreasing, or customer acquisition costs increase, then it may be time to rethink and redefine your companies position in the market.

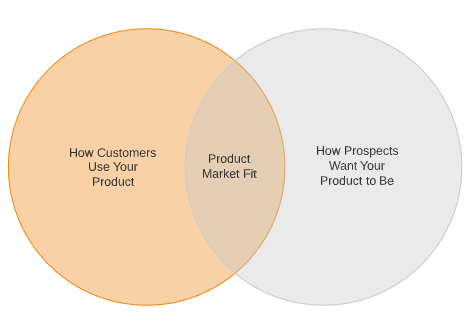

A terrific place to start is through customer conversations — engage with your target demographic and receive insight on product/service development, UX/UI design, and other predetermined questions that can give you a competitive edge. Sampling existing, prospective, and dormant customers will help you determine what and how your products or services are being used and how to better market and serve your customer base. With existing customers, these conversations should focus on how your product or service is being utilized. While speaking with prospective customers, see if you can determine what products or services they would like from you as a vendor. Do they require a niche service or product, or would they prefer a provider with wide domain expertise? The intersection of your findings from these conversations can help you better define your product-market fit, allocate developmental resources, and have you scooping up market share in no time. Ultimately, a growing business can compete by establishing niche dominance, or by proving extensive domain expertise. In both cases, a product-market fit will always be crucial. To make sure one exists, speaking with customers is the best place to start.

Diversifying Your Client Base

If your business has taken advantage of a single large customer to grow, you are not alone. The multi-billion-dollar productivity company Slack, for example, generates over 40% of its revenue from .1% of its customer base. While many successful businesses have taken this strategy of focusing on aligning with top customers to secure and develop, a highly concentrated customer base does pose revenue risk to a growing business. While it is easy to argue that fewer customers allow you to build better relationships, Forbes Magazine called concentration risk one of the greatest a small business can face.

The first step in understanding your client base and concentration risk is to analyze your accounts receivable. A good rule of thumb is that if your top five customers make up more than 25% of all outstanding accounts receivable then it may be time to expand your marketing effort and work on acquiring new customers to diversify your customer base. To maximize this effort, work with your marketing and sales departments to create key customer acquisition metrics or outsource this effort to a third party.

First, you should work to analyze the customer lifetime value of your average account. This is defined as the total revenue your business can expect to generate from an average customer. This can be done in many ways, but the best practice could be to take the average customer annual revenue and multiplying that value with the duration of the average customer relationship. Finally, factor in the profit margin of the average customer. As your analysis is developed and refined, additional inputs such as inflation, cost of capital, and contribution analysis can be performed.

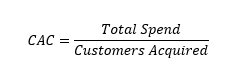

Next, you will need to analyze customer acquisition costs by dividing all marketing and sales costs in a period by the number of customers acquired in the period. Simplified, this can be represented as customer revenue multiplied by profit margin. This will allow your business to streamline and save on customer acquisition costs. Keep in mind that if you market seasonally, you will want to adjust your customer acquisition cost calculation to account for the time between marketing spend and customer onboarding. If you are using multiple marketing and sales channels, the best practice is to track channel expenses separately, and upon acquiring the customer determine what channel they were reached through.

Finally, by comparing the customer lifetime value to the customer acquisition cost you can determine a high return marketing strategy and focus on acquiring the highest value customers. By doing this, you will be in a great position to improve marketing efficiency, decrease revenue risk, and grow your business.

Keeping Your Workplace Technology in Tip Top Shape

Workplace technology, which includes everything from the computer hardware your personnel use to the CRM systems that keep it running, represents a significant investment that you have made as a business owner or executive. While the savings created by smart technology investments are researched and well documented, each technology investment decision requires human capital to deploy, understand, and maintain. As a result, you may not realize that the technology you were sold is being severely underutilized by the end-users at your firm. In fact, a study on marketing technology published by Ascend2 found that only 9% of study participants felt their technology was fully utilized. To stand out and gain a competitive advantage in your industry, focus on getting the most out of your technology stack.

One great way to better utilize your technology is to create a business culture of continuous improvement. To do this offer extensive software training to your employees so that they gain a deep understanding of the technology and its potential utilizations. With a strong technical knowledge base, employees’ frustrations can become opportunities for your firm to build key features.

Sometimes the desired solution is not readily available. In these cases, it is important for you to develop relationships with key software vendors. One amazing aspect of technology is how quickly it can be updated and improved, and a good relationship with your technology vendor will expedite the time it takes to implement these key features.

While change and improvement is great for business and efficiency, new features and releases often impact existing processes. Features move, user interfaces change, and customizations are built. Are you confident that you can keep track of these updates? If not, it may be time to consider standardizing your software development protocols, implementing a changelog, and notifying employees of changes through an internal newsletter.

Final Thoughts

Managing your business in a competitive environment is critical to long-term success. Sometimes a great partner is all your business needs, and LQD Business Finance’s Managed Services can offer a new opportunity for growth. Through close consultation and our proprietary tech stack, we can tailor business software solutions to fit your needs. Contact us today!

Sources

https://www.inc.com/guadalupe-gonzalez/slack-s1-business-model.html

https://www.forbes.com/2009/04/15/biggest-business-risks-entrepreneurs-management-risk.html#7bdf375c718b

https://neilpatel.com/blog/customer-acquisition-cost

https://metova.com/how-to-evaluate-manage-and-avoid-technical-debt/

https://gatewaycfs.com/bff/avoiding-high-customer-concentration#:~:text=A%20rule%20of%20thumb%20holds,both%20high%20and%20low%20concentrations

- Blog